In the world of business, financial transactions play a crucial role. One such transaction method that has gained popularity among businesses is the use of voucher business checks. These business checks are a convenient and secure way to make payments and keep track of expenses. In this comprehensive guide, we will explore everything you need to know about these business checks, including their benefits, how to use them, and important considerations. So, let’s dive in!

What are Voucher Business Checks?

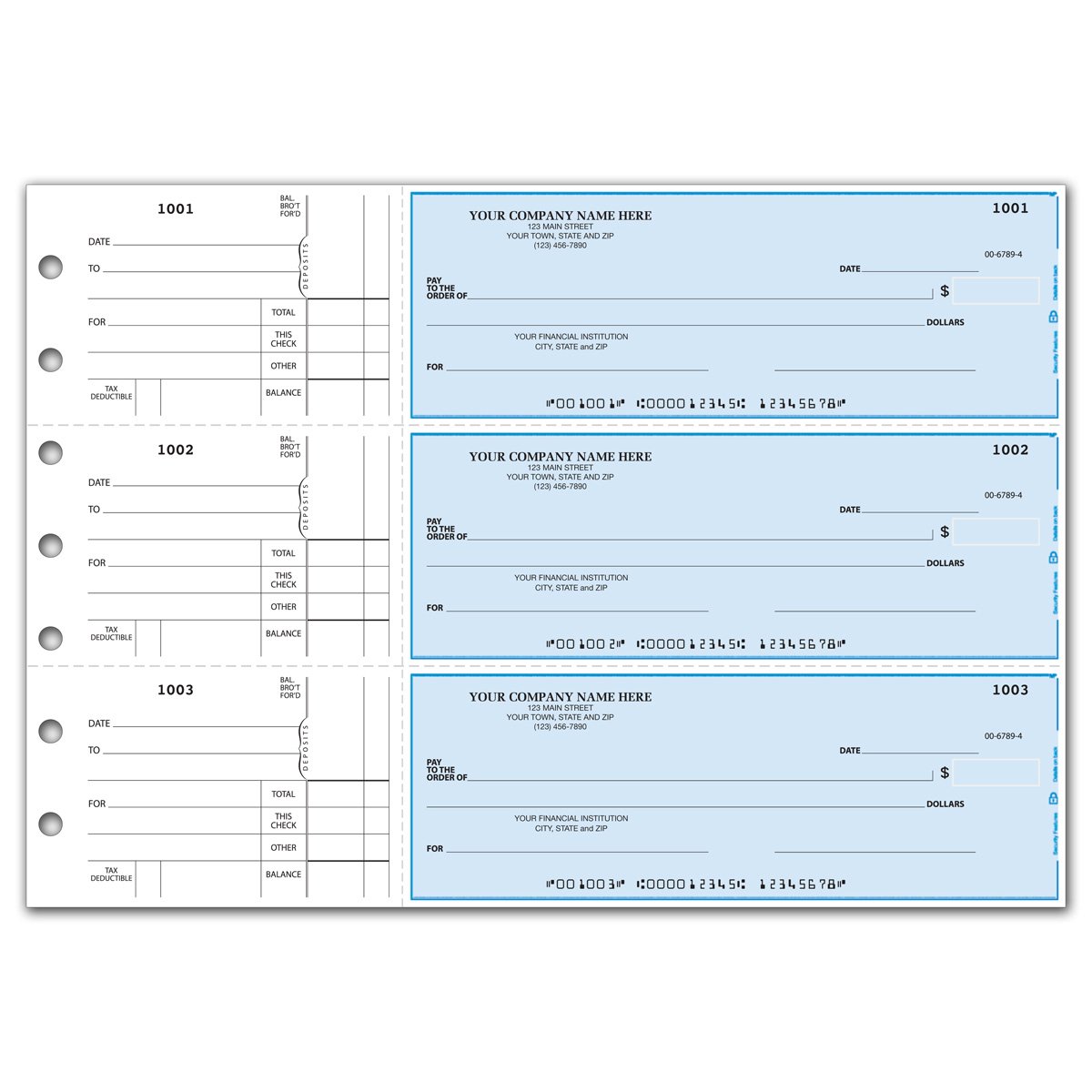

Voucher business checks are invaluable tools for efficient financial transactions within a company. These specialized forms of checks streamline payment processes by offering a comprehensive breakdown of each transaction. When businesses need to settle accounts with suppliers, vendors, or employees, these checks provide a clear record of the payment purpose, amount, and recipient.

With a detachable voucher included, extra information such as invoice numbers or purchase order details can be conveniently included, ensuring accuracy and facilitating seamless accounting procedures. By utilizing voucher business checks, companies can enhance their financial management and maintain meticulous transaction records.

Benefits of Using Voucher Business Checks

- Enhanced Record Keeping: One of the key advantages of these business checks is their ability to facilitate efficient record keeping. With each check having a detachable voucher, businesses can easily track and reconcile payments, making it simpler to manage their finances and prepare accurate financial statements.

- Improved Accountability: These business checks promote transparency and accountability within an organization. The detailed information provided on the voucher helps businesses keep track of expenses, ensuring that payments are made for legitimate purposes and reducing the risk of fraud or unauthorized transactions.

- Efficient Payment Processing: These business checks streamline the payment process. By including relevant information on the check itself, such as payment purpose and recipient details, businesses can save time and effort when it comes to reconciling payments and managing their accounts payable.

- Professional Appearance: Using business checks adds a professional touch to your business transactions. They convey a sense of reliability and trustworthiness, which can be particularly important when dealing with new vendors or suppliers.

How to Use Voucher Business Checks?

- Choose a Reliable Provider: Start by selecting a reputable provider of voucher business checks. Look for a company that offers customizable options to suit your specific needs and ensures the security of your checks.

- Customize Your Checks: Once you have chosen a provider, you can customize your business checks. Include your company name, logo, and contact information for a professional appearance. You may also want to add additional security features, such as watermarks or holograms, to prevent fraud.

- Determine Check Details: Decide what information you want to include on the voucher portion of the check. This could include invoice numbers, purchase order details, or any other relevant information that will help with record-keeping and payment reconciliation.

- Print and Distribute Checks: After customizing your checks, you can print them using your business printer or order them from your chosen provider. Ensure that you securely distribute the checks to the authorized personnel responsible for making payments.

Important Considerations About Voucher Business Checks

- Security Measures: Protecting the security of your voucher business checks is paramount. Implement security measures such as storing checks in a secure location, restricting access to authorized personnel only, and regularly auditing check usage and inventory.

- Fraud Prevention: Stay vigilant against check fraud by regularly monitoring your bank statements and reconciling payments. If any discrepancies or suspicious activities are detected, report them to your bank immediately.

- Compliance with Regulations: Ensure that these business checks comply with local laws and regulations. Familiarize yourself with any legal requirements regarding check issuance, such as the inclusion of specific information or authorized signatures.

- Transition to Digital Payments: While these business checks offer numerous benefits, consider whether transitioning to digital payment methods, such as electronic funds transfers or online payment platforms, would be more efficient for your business.

Myths on Voucher Business Checks

There are a few common myths surrounding voucher business checks that can lead to misunderstandings. Let’s debunk them:

- Voucher checks are unnecessary in the digital age: While digital payment methods have gained popularity, these business checks still hold their value. They offer tangible documentation, which can be useful for record-keeping and audits. Additionally, some businesses prefer the security and control that come with physical checks.

- Voucher checks are time-consuming: Some believe that using voucher checks adds complexity and takes up valuable time. However, with modern printing and software solutions, the process has become streamlined and efficient. Preprinted checks and integrated accounting systems minimize the time required for filling out vouchers.

- Voucher checks are only for large businesses: It’s a misconception that voucher checks are exclusively for large corporations. Businesses of all sizes can benefit from their detailed payment information. Small businesses, in particular, find voucher checks helpful in tracking expenses and maintaining accurate financial records.

- Voucher checks are expensive: While voucher checks may have an initial cost, they can actually save money in the long run. The comprehensive payment details on voucher checks can prevent errors and discrepancies, reducing the need for costly corrections or reconciliations.

- Voucher checks are prone to fraud: Some worry that the detachable vouchers on voucher checks increase the risk of fraud. However, various security features can be incorporated into these checks, including watermarks, holograms, and tamper-evident ink. Additionally, businesses can implement internal controls to prevent misuse and ensure check security.

By dispelling these myths, it becomes clear that business checks remain a valuable tool for businesses, offering detailed payment information, accurate record-keeping, and increased financial security.

Conclusion

Voucher business checks provide businesses with an effective and organized way to make payments and manage their finances. By offering detailed information on each payment, these checks enhance record-keeping, improve accountability, and streamline the payment process. However, it is crucial to prioritize security, prevent fraud, and stay compliant with relevant regulations. As technology continues to advance, businesses should also consider the feasibility of transitioning to digital payment methods. With careful implementation and management, voucher business checks can be a valuable tool for any business.