Hammer Candlestick Pattern : A Traders Guide

Introduction

Have you ever wondered how professional traders seem to predict market reversals with uncanny accuracy? One of the tools in their arsenal is the hammer candlestick pattern —a simple yet powerful visual indicator that can signal the end of a downtrend. Think of it as a traffic light, flashing green for “opportunity ahead.”

In this guide, we’ll break down what the hammer candlestick pattern is, how it works, and why it’s an essential part of your trading toolkit. We’ll also discuss the best stock market courses in India to help you master trading and elevate your skills. Ready to dive in? Let’s get started!

Discover the hammer candlestick pattern, learn from the best stock market course , and explore top stock trading courses in India to master trading.

What Is the Hammer Candlestick Pattern?

The Hammer candlestick is a single-candle reversal pattern that forms after a decline in price. It signifies a potential bullish reversal, suggesting that buyers are starting to regain control from sellers. This pattern is characterized by the following:

- A small real body near the top of the candlestick.

- A long lower shadow that is at least twice the size of the body.

- Little or no upper shadow.

The pattern resembles a hammer, hence its name, and typically appears at the end of a downtrend.

Key Features of the Hammer Pattern

- Location: Appears at the bottom of a downtrend.

- Real Body: Indicates the difference between the opening and closing prices, which is small and situated at the top.

- Lower Shadow: Reflects significant buying interest, as prices recovered strongly from the session’s low.

- No Upper Shadow: Reinforces the dominance of buyers during the trading session.

What Does the Hammer Candlestick Indicate?

The Hammer suggests that even though sellers pushed the price lower during the session, buyers managed to drive it back up before the close. This recovery demonstrates a shift in momentum from bearish to bullish, hinting at a potential trend reversal.

How to Identify a Hammer Candlestick in Charts?

To spot a Hammer candlestick:

- Look for a candlestick with a small body and a long lower shadow after a series of declining candles.

- Ensure the lower shadow is at least twice the size of the body.

- Confirm the absence of a significant upper shadow.

Example: Hammer in Action

Consider a stock that has been declining over several days. On the next trading day, a candlestick with the following attributes forms:

- Open: ₹50

- Low: ₹45

- Close: ₹51

- High: ₹51

This candlestick has a long lower shadow (₹45 to ₹50) and a small real body near the top. This formation signals that buyers have stepped in, creating a bullish reversal opportunity.

Hammer vs. Hanging Man: Know the Difference

While the Hammer appears at the bottom of a downtrend and signals a bullish reversal, the Hanging Man forms at the top of an uptrend, indicating a potential bearish reversal. Both patterns look similar but differ in their implications based on location.

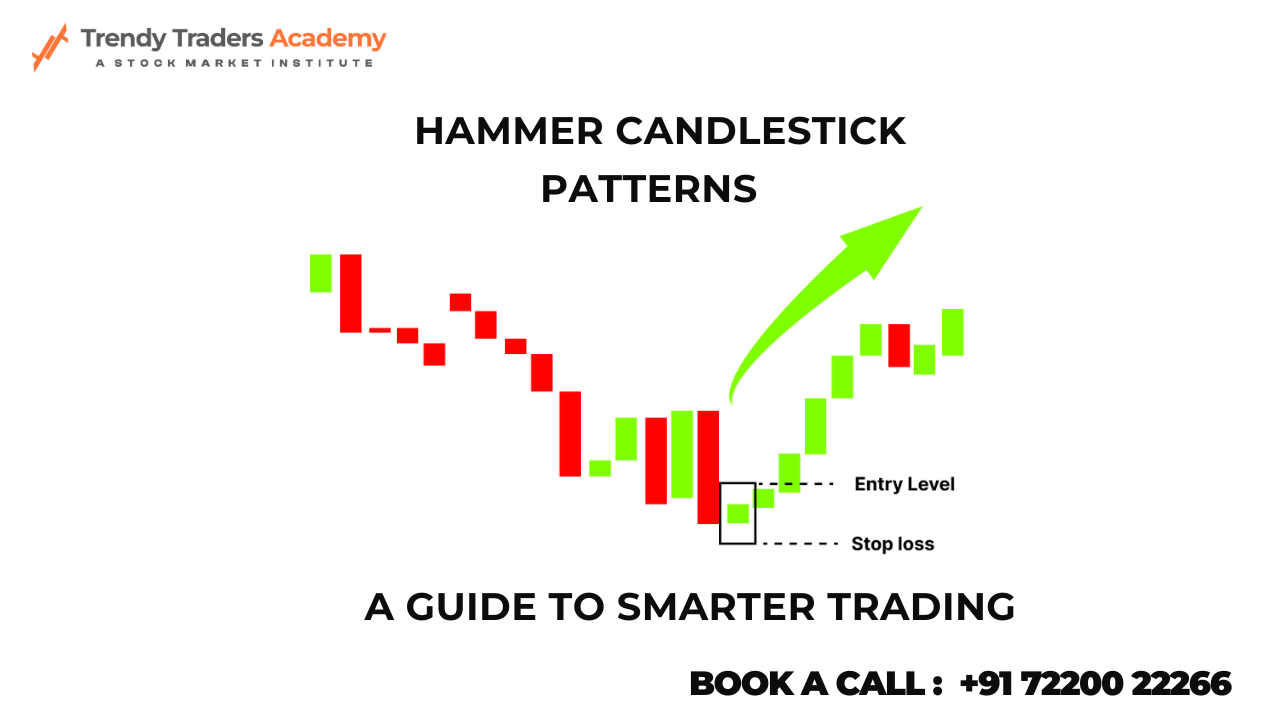

How to Trade the Hammer Candlestick Pattern?

Here are some steps to incorporate the Hammer pattern into your trading strategy:

- Confirm the Trend: Ensure the Hammer forms after a clear downtrend.

- Volume Analysis: Higher trading volume during the Hammer session strengthens its reliability.

- Confirmation Candle: Wait for the next candle to close above the Hammer to validate the reversal signal.

- Set Stop-Loss: Place a stop-loss below the low of the Hammer candlestick to manage risk.

- Take Profit: Use nearby resistance levels to determine your profit targets.

Example Strategy

If a Hammer forms at a support level, it might indicate that buyers are defending the price. After the next candle confirms the reversal:

- Buy: Enter a long position.

- Stop-Loss: Place it just below the Hammer’s low.

- Take Profit: Target the next resistance zone.

The Limitations of the Hammer Pattern

While the Hammer is a powerful reversal signal, it is not foolproof.

- It works best when combined with other indicators like RSI or MACD.

- False signals can occur in weak market conditions or without confirmation.

- It should be used in conjunction with a broader trading strategy.

Real-Life Examples in Stock Trading

The hammer candlestick pattern has been spotted in stocks like Reliance and TCS during major market corrections. Identifying these patterns early can help traders make informed decisions and capitalize on reversals.

Why Every Trader Should Learn the Hammer Pattern

Mastering the hammer pattern isn’t just for pros. It’s a beginner-friendly tool that gives you an edge. By understanding this pattern, you can anticipate price movements and make strategic trades.

Combining the Hammer with Other Indicators

The hammer pattern works best when used with other indicators like:

- Moving Averages: To confirm trends.

- RSI (Relative Strength Index): To gauge momentum.

- Volume Analysis: To verify the strength of the reversal.

Common Mistakes Traders Make with Hammer Patterns

Even experienced traders can falter. Here are common pitfalls:

- Misidentifying the pattern.

- Ignoring the trend context.

- Relying solely on the hammer without other confirmations.

Learning the Pattern: Best Stock Market Courses

To truly master the hammer candlestick, you need proper guidance. The best stock market courses teach you how to interpret candlestick charts, use indicators, and strategize effectively.

Stock Trading Courses in India: Your Path to Success

India offers a plethora of options for learning trading, from Trendy Traders Academy to online platforms. Enrolling in a course stock market tailored to your skill level is your first step toward success.

Tools and Platforms for Practicing the Hammer Pattern

Before you dive into live trading, practice on platforms like:

- TradingView

- Zerodha Kite

- Upstox

Advanced Tips for Mastering the Hammer Candlestick

Want to level up? Pay attention to:

- Multi-timeframe analysis.

- Combining hammers with support and resistance zones.

- Backtesting strategies to refine your approach.

Practical Application: Your Next Trade

The next time you spot a hammer pattern, follow these steps:

- Confirm with other indicators.

- Set your stop-loss just below the pattern.

- Plan your exit strategy for maximum profit.

How to Choose the Right Stock Market Course

Not all courses are created equal. Look for:

- Experienced mentors.

- Comprehensive curriculum.

- Real-world examples and case studies.

Conclusion: Your Journey to Trading Success

The hammer candlestick pattern is more than just a visual cue; it’s a gateway to smarter trading. Whether you’re a newbie or a seasoned trader, mastering this pattern can transform your trading game. Pair it with the best stock trading courses India and practical experience to unlock your potential.

FAQs

1. What is the hammer candlestick pattern?

The hammer candlestick pattern is a single-candle chart pattern that signals a potential reversal in a downtrend, often leading to a bullish move.

2. How is the hammer candlestick different from the inverted hammer?

While the hammer has a long lower shadow, the inverted hammer candlestick pattern has a long upper shadow, but both indicate potential reversals.

3. Can I trade solely based on the hammer candlestick pattern?

No, it’s best to combine the hammer with other indicators like RSI or volume for confirmation.

4. Are there any free stock market courses in India?

Yes, many platforms like Trendy Traders Academy and online resources offer free or affordable introductory courses.

5. How long does it take to master candlestick patterns?

With consistent practice and the right course, you can start identifying patterns within a few months.

By understanding the hammer candlestick pattern and complementing it with a stock trading course, you’re one step closer to mastering the art of trading.